For many IT specialists, Silicon Valley is the most desirable place to live. It’s a global center for innovation and high technology as well as a large cluster of IT majors such as Apple, Cisco, Facebook, Intel, Twitter, and more. It’s also one of the most expensive regions on the planet.

Part 1 of this article covered shipping and flight costs, rental and home purchase prices as well as utility bills in Silicon Valley. In Part 2, you’ll learn about other expenses related to living in Silicon Valley: child care expenses, groceries, public transportation, car expenses, health insurance, household goods, and more.

Child care expenses

If you have children, you’re likely to pay for a kindergarten or school.

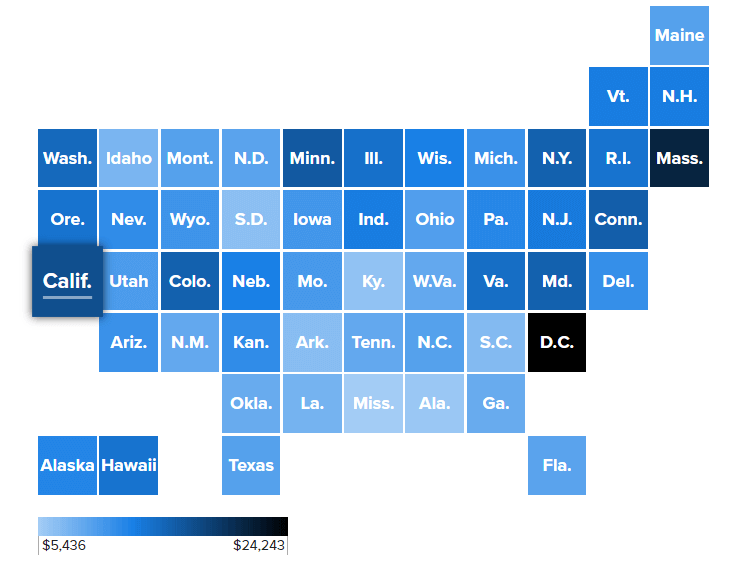

California is not the most expensive U.S. state in terms of child care costs, however, it’s one of the least affordable ones. According to the Economic Policy Institute, the annual infant care costs in California are $16,945 (or about $1,400 per month).

Source: Economic Policy Institute

According to Kidsdata.org, family child care homes can be less expensive ($11,720 to $15,500 per year for infants and $10,975 to $15,180 for preschoolers), while child care centers cost $17,380 to $23,110 for infants and $12,170 to $17,660 for preschoolers.

Public schools typically provide free half-day kindergarten programs (about 3 hours) for district residents. Although some provide full-day programs (about 6 hours) for free, others charge full-day tuition of $1,000 – 5,000 or more for 10 months (September to May).

If you have a preschooler, expect to pay around $500 for a babysitter, $1,000 – 2,500 a month for a kindergarten, or $1,500 – 3,000 for a kindergarten and a babysitter.

If you have school-age children, they can attend a public school for free or a private school for about $1,500 – 3,000 a month. Note that schools with religious education tend to be more expensive. Many private schools offer a sibling discount for multiple students from the same family.

If you have a school-age child, you should pay attention to the school rating in the area where you intend to settle. Keep in mind, though, that the higher the school’s rating is, the more expensive real estate in the area.

Here are examples of monthly tuition costs in Silicon Valley (according to Private School Review):

- SAGE Academy, Campbell (grades: PK–12): $1,200

- Montessori House of Children, San Francisco (grades: NS–PK): $1,330

- Rising Star Montessori, Alameda (grades: PK–K): $1,398

- My Own Montessori, Oakland (grades: PK–K): $1,500

- Fountainhead Montessori School, Dublin (grades: NS–6): $1,600

- Montessori Elementary School, Alameda (grades: PK–8): $1,700

- Mother Goose School, San Francisco (grades: NS–K): $1,800

- Roberts School, Menlo Park (grades: NS–PK): $1,985

- Mountain Blvd Montessori School, Oakland (grades: K): $1,995

- Light Islamic Academy, Oakland (grades: PK–12): $6,000

- North Hills Christian School, Vallejo (grades: NS–12): $6,000

(PK means “Pre-kindergarten”, NS “Nursery”, K “Kindergarten”, and 12 is the last grade for 17–18 year-olds).

There may be other expenses in addition to tuition costs:

- School lunch or bag lunch: $2–3 per day (some private schools include the cost of lunch in the tuition)

- Bus pass: $100–325 per year

- Before and after school care: $100–800 per month

- One-time contribution to facility maintenance: $1,000 – 2,000 (in some private schools)

- School extracurricular activity fees: $220 per year

- Sports: $100–500 per month

- Piano, violin, language or art lessons: $30–100 per hour or $1,500 – 3,200 per year

- Tutoring programs to boost grades: $400 per month for 8 hours of tutoring

According to GradePower Learning, the final numbers range from $1,020 to $20,520 per year for public school education, depending on grade level. Twelfth grade is often the highest cost, due to greater involvement in activities.

In the private school system, these costs are much higher. On average, parents can expect to spend between $8,790 to $33,550, depending on grade level.

Source: GradePower Learning

Child care costs subtotal:

- Single person: $0

- Couple: $0

- Couple with a preschooler: $1,000 – 3,000/month

- Couple with a school-age child: $1,500 – 3,000/month

- Couple with two school-age children: $3,000 – 6,000/month

Groceries

Another important part of expenses is groceries. It’s hard to measure these expenses since every person has their own eating habits. Expect to pay for food at least $400–500 a month per adult person.

Here are examples of grocery prices in Silicon Valley (according to Numbeo):

- Meal, inexpensive restaurant: $10–30

- Meal for two people, mid-range restaurant, three-course: $45–150

- McMeal at McDonald’s (or equivalent combo meal): $7.5 – 12

- Cappuccino (regular): $3–8

- Milk, 1 liter: $1–2

- Loaf of white bread (500 g): $2–6

- Rice (white), 1kg: $1.5 – 11

- Eggs (12): $2–6

- Local cheese (1 kg): $5.5 – 44

- Chicken fillets (1 kg): $3.5 – 20

- Beef round (1 kg): $15–26

- Apples (1 kg): $1–9

- Banana (1 kg): $1–4

- Oranges (1 kg): $2–13

- Tomato (1 kg): $2–10

- Potato (1 kg): $1–7

- Onion (1 kg): $1–7

- Lettuce (1 head): $1 – 2.5

- Water (1.5 liter bottle): $1–4

- Bottle of wine (mid-range): $7–25

- Domestic beer (0.5 liter bottle): $2–6

- Imported beer (0.33 liter bottle): $1–6

Note that many restaurants and bars have happy hours when you can get discounts on food and drinks.

Also note that in restaurants, it’s customary to tip waiters 15–20% of the pre-tax bill. (Hot-prepared food products in California are subject to 7.25% state sales tax rate plus the local district tax rate (0.10% to 1%)).

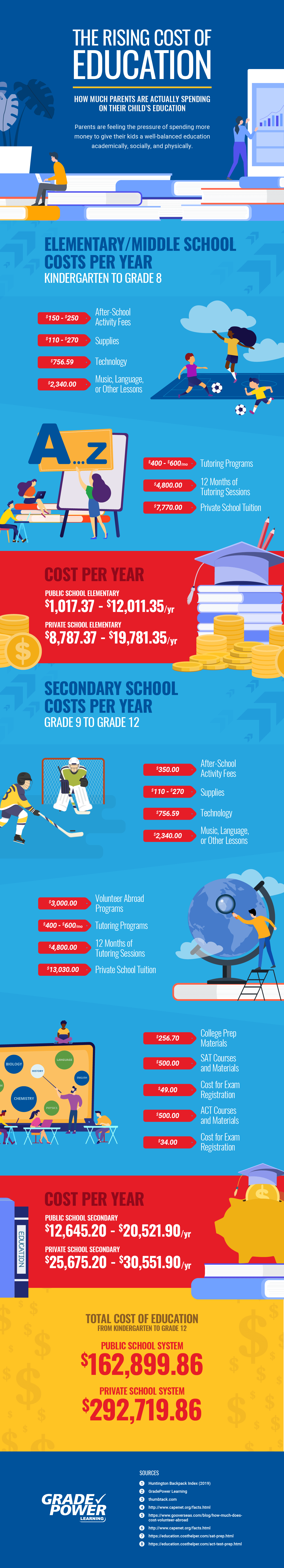

Source: Mountain View Walmart, fall 2020 weekly ads

Groceries subtotal:

- Single person: $400–500/month

- Couple: $800 – 1,000/month

- Couple with a child: $1,000 – 1,500/month

- Couple with two children: $1,500 – 2,500/month

- Groceries, food delivery, and restaurants for a family of three: $3,000 – 3,500/month

Public transportation

If you live in San Francisco, you might not need a car since you can easily get by with public transportation: you can travel by bus, tram, or train. Other towns in Silicon Valley also have good public transportation systems as well as dedicated bike lanes.

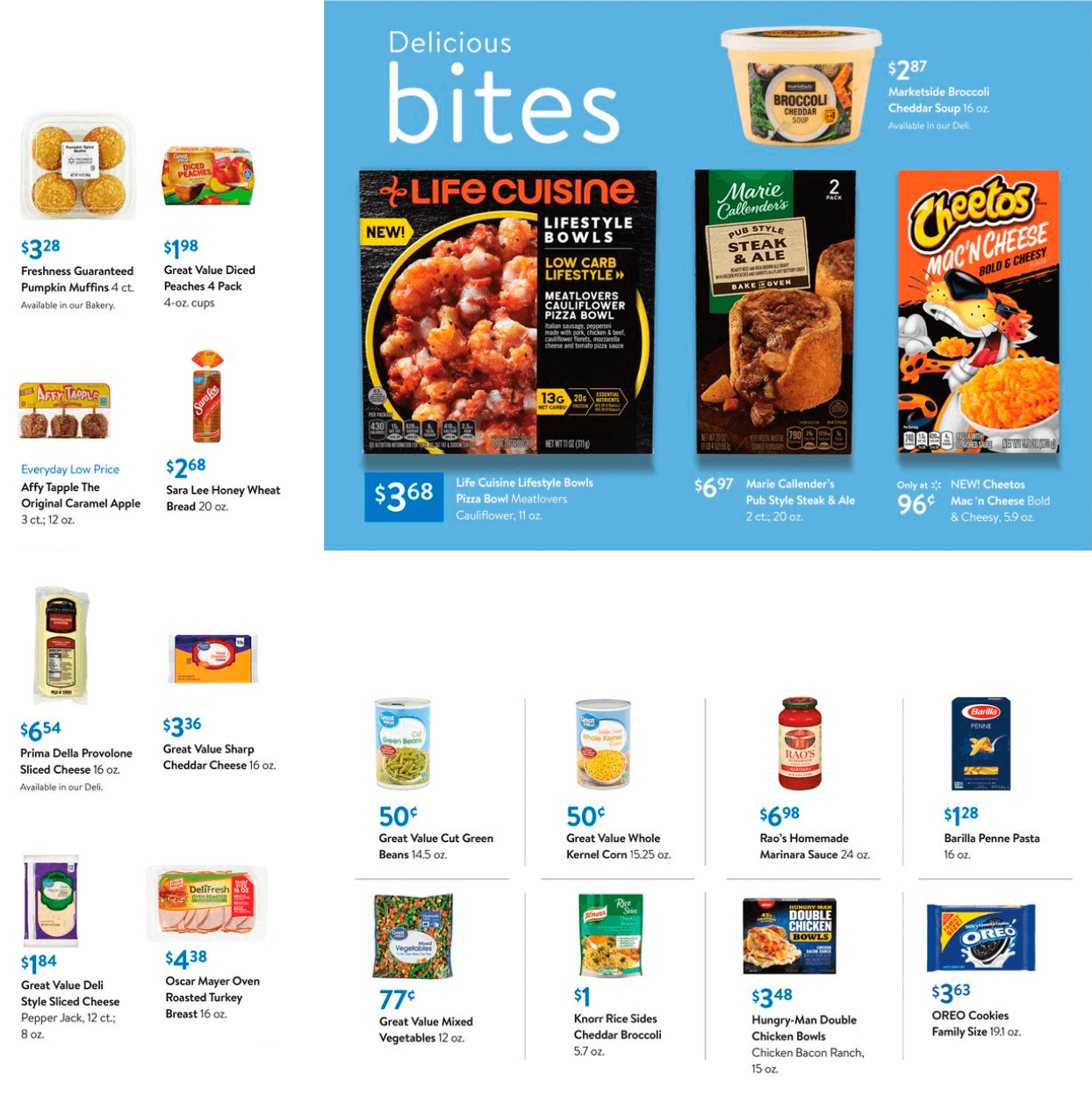

Most cities in the Valley are connected with the Caltrain commuter rail line, which goes from San Francisco to San Jose. Here are prices for a monthly Caltrain pass (according to Caltrain website):

- San Francisco — South San Francisco, San Bruno (Zone 1): $96

- San Francisco — Redwood City (Zone 2): $163.5

- San Francisco — Menlo Park, Palo Alto, Mountain View (Zone 3): $231

- San Francisco — San Jose (Zone 4): $298.5

Source: Caltrain.com

Caltrain one-way tickets cost $3.75 to $15 depending on the zone ($3.20 –to $14.45 for Clipper Card holders). Day passes cost from $7.50 to $30. A Clipper Card will allow you to buy passes and tickets for lower prices. Also, passes and tickets for children are sold for about half the price of the regular fare.

There’s also the Acetrain network that takes passengers out of San Jose towards Livermore and Stockton. Buses run rarely, and the price is about $5 per trip.

Public transportation is not popular in some of the towns in Silicon Valley, including Palo Alto. The main means of transportation there is a personal car as well as Uber or Lyft. Travel for short distances (10–15 minutes) using Uber or Lyft costs about $10–15 (including tax and tip). A trip from Palo Alto to San Francisco would cost $35–55.

Some people also use the Turo app to rent a car. It costs $30 to $180 a day.

Public transport subtotal:

- Single person: $100–300/month

- Couple: $200–500/month

- Couple with a child: $200–650/month

- Couple with two children: $200–700/month

Car expenses

If public transport is not your cup of tea, you might want to have a car. In fact, the car is the most popular mode of transport in Silicon Valley outside San Francisco and Oakland.

Monthly car expenses, including insurance and maintenance, can vary greatly depending on many factors: the class of the car, the maintenance plan at the dealership, and the type of transaction (purchase or lease). In the latter case, costs also depend on the number of miles per year that are allowed on the car.

Leasing. Most people in California don’t buy cars but lease them. It means that they use a car for, say, three years, and after three years, they return the car to the car dealer. Tesla Model X leasing costs about $1,020 per month (plus a one-time down payment of $7,500). A simpler car can cost $200–450 per month.

Car insurance can be expensive and can reach several thousand dollars a year. According to CarInsurance.com, the average car insurance rate in California is $2,125 a year ($177 monthly) for full coverage and $752 for liability only (it covers only injuries or damages to third parties and their property). Minimum coverage insurance costs $606 on average.

Liability limits can be $50,000 per person, $100,000 per accident, and $50,000 property damage. The 50/100/50 insurance costs $470 to $918 per year.

Liability limits can also be $100,000 per person, $300,000 per accident, and $100,000 property damage. The 100/300/100 insurance costs $1,490 to $2,510 per year depending on the insurance company.

Gas prices in the U.S. are volatile and tied to oil prices and sometimes can change during a single day. The average gas prices in California are around $4 per gallon (about $1 per liter). With fuel consumption of 22 miles per gallon (10.5 liters per 100 km) and average mileage of 15,000 miles per year (24,140 km), you’ll have to pay around $200 a month for gas. If you have two cars, multiply this by two.

Source: Silicon Valley Institute for Regional Studies

Car maintenance costs $300–600 a month, including visits to service centers, replacing tires and brake pads, regularly changing air and oil filters (every 10,000 miles), and rotating the wheels every 5,000 miles. However, with a new car, you may not experience maintenance costs this high, especially if you’re covered by the manufacturer warranty.

Car expenses subtotal:

- Single person: $1,000 – 1,500/month

- Couple: $1,000 – 1,500/month

- Couple with a child: $1,000 – 1,500/month

- Couple with two children (two cars): $2,000 – 3,000/month

Health insurance

Health insurance for employees is normally subsidized by employers. Insurance for family members is usually subsidized only partially. Be ready to pay at least $400–700 per month for your spouse and child.

Some of the insurance companies in California include Valley Health Plan, Kaiser Permanente, Anthem BlueCross, and Blue of California. They usually offer Silver, Bronze, Gold, and Platinum health insurance plans, with prices depending on deductibles and health care services.

Here are examples of plan prices according to Healthforcalifornia.com (for a married couple with a child in San Jose):

- Bronze plans: $670 – 1,430 per month. These plans are for those who don’t go to the doctor very often. You get free preventive care, a free annual check-up, 3 primary doctor visits for $65 each, and labs at $40. Other than that, you will pay regular prices until you hit a $6,300 deductible. After $6,300 you will have discounted rates until you hit a $7,800 out-of-pocket maximum.

- Silver plans: $990 – 1,830 per month. These plans include discounted rates right away on doctor visits, labs, and x-rays. After a $300 drug deductible, you’ll get discounted rates on generic and brand name prescriptions. After a $ 4000 deductible, you pay 20% of hospitalization and surgery until you reach a $7,800 out-of-pocket maximum.

- Gold plans: $1,240 – 1,680 per month. These plans offer no deductibles and low copays for doctor visits, x-rays, and prescription drugs. For hospitalization and surgery, you pay 20% until you reach an out-of-pocket maximum of $7,800.

- Platinum plans: $1,425 – 2,900 per month. These plans offer no deductibles and very low copays for doctor visits, labs, x-rays, and prescription drugs. For hospitalization and surgery, you pay 10% until you reach an out-of-pocket maximum of $4,500.

For example, Kaiser Permanente’s Silver Plan costs $444/month for a single person, $889/month for a couple, $1,176 /month for a couple with a child, and $1,463/month for a couple with two children.

Here’s what is included in Kaiser Permanente’s Silver Plan ($1,176 /month for a couple with a child):

- Annual medical deductible: $4,000 per individual, $8,000 per family

- Annual drug deductible: $300 per individual, $600 per family

- Annual out-of-pocket maximum: $7,800 per individual, $15,600 per family

- Preventive care visit: $0

- Primary care visit: $40

- Urgent care visit: $40

- Specialty care visit: $80

- Lab tests: $40

- X-rays: $85

- Imaging (CT/PET scans, MRIs): $325

- Emergency room: $400

- Hospitalization: 20% after deductible

- Drugs: $16–90 after deductible

Health insurance subtotal:

- Single person: $0 (subsidized by the employer)

- Couple: $400–500/month

- Couple with a child: $700–750/month

- Couple with two children: $1,000 – 1,500/month

Entertainment

Trips to movie theaters, theaters, museums, amusement parks, going to concerts, musicals, and other entertainment events will cost an average of $1,800 – 3,000 per year per person, or $150–250 per month. Here are a few examples:

- Movie tickets: $15–20

- Museum: $15–30

- Theater: $100

- Opera: from $150

- Hobbies (books, courses, etc.): $100–400

- Software, streaming services, devices: $100–400

- Gym membership: $30–60 a month

Entertainment subtotal:

- Single person: $150–250/month

- Couple: $300–500/month

- Couple with a child: $450–750/month

- Couple with two children: $600 – 1,000/month

Furniture, household goods, and electronics

During your first year in Silicon Valley, you might have to buy furniture, appliances, and other stuff for your new home, especially if you haven’t ordered the shipping of your personal belongings from your home country.

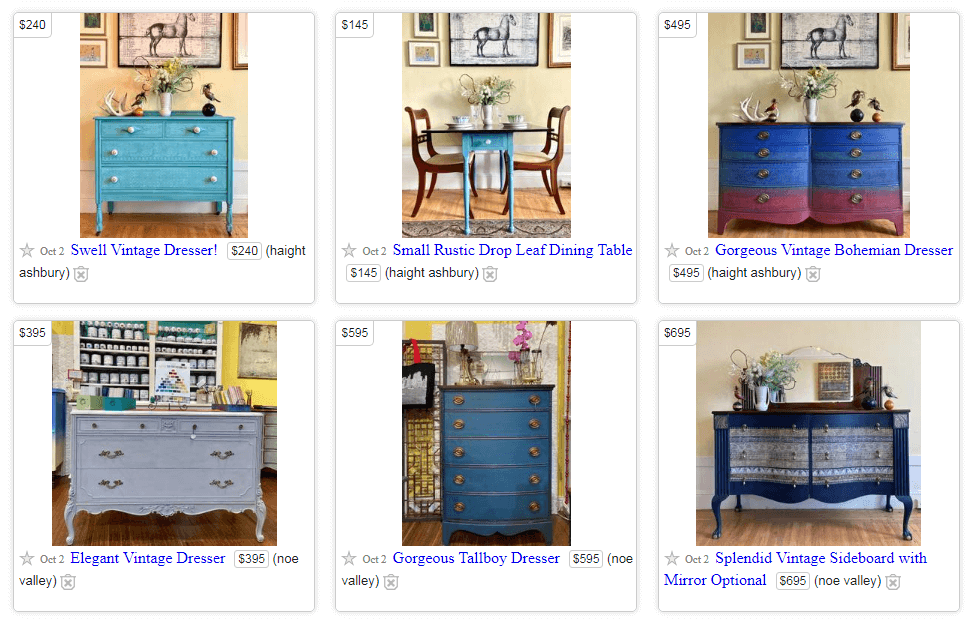

Household goods will cost an average of $200 a month per adult during the first year. You can purchase new household goods and furniture in Ikea or similar stores, and you can also find used stuff on sfbay.craigslist.org or in Facebook groups.

Examples of prices for used furniture offered on Craigslist in the San Francisco Bay Area:

- Two Ikea chairs: $25

- Coffee table: $40

- Office chair: $90

- Computer desk: $95–200

- TV stand: $75–265

- Two comfy chairs: $400

- Bookcase: $150–500

- Dining table: $600

- Dresser: $800

- Sofa: $400–800

- Bed: $300 – 1,300

Source: sfbay.craigslist.org

Examples of prices for used household goods offered on Craigslist in the San Francisco Bay Area:

- Dining silverware: $10

- Iron: $15

- Two ceramic jars: $15

- Ironing board: $40

- Knife set: $50

- Vacuum cleaner: $65

- Brass table lamp: $100

- Tea set: $100

- Oriental rug: $150–330

- Wool rug: $1,000 – 1,500

You might also have to buy electronic appliances. These expenses are around $150–200 per month per family member.

Examples of prices for used electronic appliances on Craigslist in the San Francisco Bay Area:

- Blender: $30–40

- Microwave: $25–70

- Electric stove and oven: $100

- Refrigerator: $800

- Washer and dryer: $470 – 1,000

Examples of prices for new electronic appliances in the Best Buy electronics retailer:

- Tablet: $130 – 1,500

- Washing machine: $500 – 1,800

- Microwave: $50 – 2,000

- 4K Ultra HD TV: $300 – 2,700

- Dishwasher: $300 – 2,800

- Laptop: $300 – 4,000

- Desktop computer: $1,500 – 4,800

- Refrigerator: $260 – 11,860

Furniture, household goods, and electronics subtotal:

- Single person: $1,200 – 2,400

- Couple: $4,000 – 5,000

- Couple with a child: $5,000 – 7,000

- Couple with two children: $5,000 – 8,000

Personal goods

Don’t forget that you’ll also need personal items such as clothes, accessories, personal hygiene products, cosmetics, etc. Although it’s hard to estimate these costs as we’re all very different, be ready to spend on personal goods around $200 a month per person.

Here are a few examples of personal goods prices in Silicon Valley according to Expatistan:

- 1 pair of jeans (Levis 501 or similar): $50

- 1 summer dress in a high street store (Zara, H&M, or similar retailers): $50

- 1 pair of sports shoes (Nike, Adidas, or equivalent brands): $92

- 1 pair of men’s leather business shoes: $112

- 1 box of 32 tampons (Tampax, OB, or similar): $7

- Deodorant, roll-on (50 ml, ≈ 1.5 oz.): $3.78

- Hair shampoo 2-in-1 (400 ml, ≈ 12 oz.): $5.45

- 4 rolls of toilet paper: $3.33

- Tube of toothpaste: $1.86

Note that people who love shopping and have additional needs, such as visits to beauticians and nail technicians, might have their expenses increase to $2,000 or even more.

Personal goods subtotal:

- Single person: $200–300/month

- Couple: $400–600/month

- Couple with a child: $500–750/month

- Couple with two children: $600–900/month

Bottom line

A single person needs a minimum of $53,400 per year to live in Silicon Valley or about $78,000 for better living. The minimum annual expenses are as follows:

- Housing: 32,400 (rent with utilities)

- Car: 12,000 (leasing, insurance, gas, and maintenance)

- Groceries: 4,800

- Other: 4,200 (entertainment and personal goods)

- Total: $53,400

If your annual salary is $150,000 (which is approximately how much you can earn in Silicon Valley as an experienced IT worker at a large company), you’ll pay in taxes roughly $50,000, and you’ll take home $100,000. With expenses of $53,400 to $78,000 per year, you’ll still have $22,000 to $46,600 left. Of course, if you want to take a mortgage and buy a fancy car, your expenses would be much higher.

A couple with a child needs a minimum of $134,400 per year or $190,800 for better living. The minimum annual expenses are as follows:

- Housing: $78,600 (rent with utilities)

- Car: $12,000 (leasing, insurance, gas, and maintenance)

- Child care: $12,000

- Groceries: $12,000

- Other: $19,800 (entertainment, health insurance, and personal goods)

- Total: $134,400

With an annual salary of $150,000, you’ll have around $114,000 after taxes (if you file your taxes as a married couple), so you’ll probably need to earn more or have a working partner to afford a comfortable life in Silicon Valley as a family.

Expenses for a couple with two children can be even higher: $174,200 to $285,600 depending on their way of living, individual circumstances, and spending habits.

What is a good salary in Silicon Valley?

The average household income in Silicon Valley is around $126,000, according to Silicon Valley Institute for Regional Studies. And $192,530 per year is “in the upper-income tier” for a household of up to three people or middle class for four persons in San Francisco, according to Curbed. In other words, if you have children, a family income of $140,000 – 200,000 after taxes should be enough. You may consider this a living wage in Silicon Valley.

Note that all of these calculations are approximate and your expenses may differ, especially when it comes to spending on personal items, clothing, and household items. By the way, don’t forget that only one person in the family works in our calculations, and $150,000 mentioned in the article is the base salary with no bonuses included.