Unlimited employment contract, visa sponsorship and one-way tickets for the whole family, 30% tax ruling, payment for the transportation of personal belongings and for temporary housing for the first month, assistance in finding a long-term apartment and opening a bank account, €1,500 upon arrival, year-end bonuses, free lunches, fruit, tea and coffee in the office… Does it sound like a dream to you? In fact, these are typical conditions offered by tech companies in the Netherlands.

Let’s dig deeper to learn more about workplace culture and working conditions in this country.

Starting employment

Before you start your employment in the Netherlands, you agree for a trial period, which is usually 2 months. The term of the trial period should be stated in your employment contract.

There are employment contracts of three types for IT workers in the Netherlands:

- Permanent (unlimited) contract. Pros: the migration service issues a residence permit for 5 years at once, you can get a mortgage, it is more difficult to fire you. Cons: remuneration can be lower than it could be with contracts of other types.

- Temporary contract (from 3 to 12 months). Pros: you’re paid more. Cons: a residence permit is issued only for the duration of the contract, the contract may not be extended, the bank most likely will not give a mortgage if the contract is shorter than 1 year.

- Mixed contract (a combination of the previous two). An intermediary office concludes a permanent contract with the employee and refers the specialist to the employer. Contracts between the two companies are concluded for short periods (normally 3 months). Pros: you will continue to receive a full salary even if the employer does not renew the contract. Cons: they sell you as an expert, but pay you as an intern.

A temporary contract can be renewed for a year or two, but the third contract must be permanent. It’s almost impossible to fire people with permanent contracts. By law, the employer must pay at least one salary for each year of the employee’s work if there are good reasons for dismissal. If there are no good reasons, the employee receives their wage for two years.

Workplace environment

Most medium-sized and large tech companies in the Netherlands are multinational. English is often a corporate language. However, some companies require employees to know or at least intend to learn Dutch.

Team relationships are usually good. Workplace culture is characterized by a flat hierarchy, and there is no great distance between ordinary employees and management. People in management roles usually do not have separate offices and work in the same open space as the employees.

There are no problems or restrictions associated with moving up the career ladder: you just need to meet the requirements of the position. For example, a software developer needs to be professional and behave accordingly.

Note that Dutch love specialization of labor and are normally not very good with multitasking. For example, someone’s job is to take a picture, and yours is to embed it on the website. If someone is asked to do both things, the system collapses. Dutch can successfully take existing technologies and optimize them when working in a stable industry where each person is responsible for one task. However, when it comes to constantly changing industries, such as game development, working processes may not be that effective.

30% tax ruling

Another thing is that taxes in the Netherlands are high. If you make €60,000 a year living in this country, you will be taxed around €22,410, and your net monthly income would be less than €40,400. The good news is that IT workers who come to the Netherlands can be granted the 30% ruling for the first 5 years, with which their net salary will be higher — almost €50,000 a year.

The 30% ruling is a tax advantage for incoming high-skilled employees in the Netherlands. If you meet specific requirements, you can get a tax allowance amounting to 30% of your salary subject to Dutch payroll tax. The result is the taxable part of your salary reduced to 70%; on top of that, the 30% allowance is paid so that the total stays 100%.

Here are requirements you need to meet to be eligible for the 30% ruling:

- Your taxable salary (70%) is at least €38,347 (€54,781 before tax)

- You’re younger than 30, you have obtained a master’s degree at a foreign university, and your taxable salary (70%) is at least €29,149 (€41,641 before tax)

- You have lived at least 150 km from the Dutch border before moving to the Netherlands (during at least 16 months in the last 24 months before you started to work in the country)

Working remotely

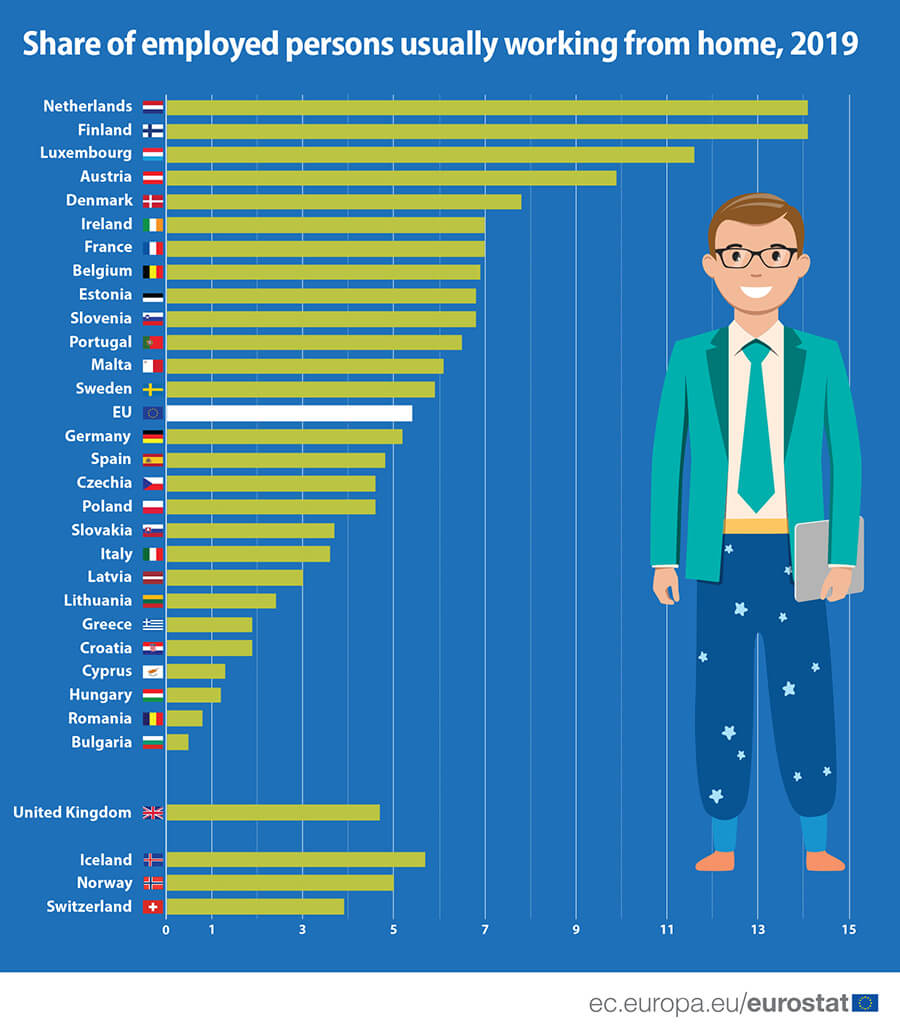

Many Dutch companies offer their employees an opportunity to work from home one or more days a week.

The Netherlands is the European leader in terms of remote work. Even before the COVID-19 pandemic, more than 14% of all employees in the country have been accustomed to working from home — much more than in the EU on average (5%).

The Netherlands has enough public spaces to work remotely. Public libraries have evolved into huge and comfortable modern coworking spaces. There you can always find a cozy corner to sit with your laptop. There is also a great number of small coffee shops, whose business models are partly focused on serving remote workers.

Working hours

The majority of full-time (“voltijd”) jobs in the Netherlands are between 36–40 hours a week, or 7 to 8 hours a day, 5 days a week. However, some companies have a 40-hour working week instead of the standard 38 hours. In this case, employees receive higher remuneration for more hours worked.

A typical working day is from 8:00 – 8:30 am to 4:00 – 5:30 pm. An employee in the Netherlands normally spends exactly 8 hours in the office, plus a lunch break (no more than an hour).

An integral part of any workday at a Dutch tech company is meetings. Be ready for daily planning meetings, retrospective meetings, planning sprints, detailed team analysis of upcoming tasks, separate meetings for scrum masters and tech leads, technical committee meetings, etc.

Working overtime is a rare case. Whether or not you receive compensation for hours worked overtime depends on the conditions specified in your employment contract.

Rest periods and holidays

Employees in the Netherlands are entitled to a maximum of 10 paid public holidays:

- New Year’s Day (January 1)

- Good Friday (March/April)

- Easter Sunday (March/April)

- Easter Monday (March/April)

- Ascension Day (May/June)

- Whit Monday (May/June)

- King’s Day (April)

- Liberation Day (May 5)

- Christmas Day (December 25)

- Boxing Day (December 26)

Good Friday and Liberation Day may be or may be not days off depending on your employment contract. Contracts might also state that a Christian public holiday can be substituted for an alternative religious holiday, e.g. Eid al-Fitr at the end of Ramadan or Chanukah.

Annual leave

Full-time employees in the Netherlands are entitled to a minimum of 20 days (4 weeks) of paid holiday leave per year. However, many companies offer between 24 and 32 days of annual leave. The number of vacation days (“vakantiedagen”) should be stated in your employment contract.

The majority of employers allow a maximum consecutive holiday period of 2 to 3 weeks. Employees usually take their vacation in July or August with an additional 7–10 days at the end of the year.

There are also companies, e.g. ING Bank, that have an unlimited vacation policy. It means that workers can take as many days off as they like as long as it doesn’t hurt their projects.

Sick leave

Coming to work sick in the Netherlands is considered poor manners so employees who feel unwell usually go on sick leave (“ziekteverlof”). You should inform your employer (manager or HR department) of your sickness by phone or email, or by sending a message.

If you are sick during your holiday, and you inform your employer, it’s possible to have those days counted as paid sick leave instead of holiday leave.

Employees in the Netherlands are also entitled to care leave (“zorgverlof”) to care for a sick child or another family member who is not in the hospital. Within 12 months, employees are entitled to a care leave equal to twice their weekly working hours. During this time, the employer must pay at least 70% of the worker’s salary.

Parental benefits

If you are employed in the Netherlands and you become pregnant, you are entitled to at least 16 weeks paid maternity leave (“zwangerschapsverlof”). You must inform your employer at least 3 weeks before you want to take maternity leave.

Expectant mothers start their maternity leave from 4 to 6 weeks before the date of giving birth. This period before the birth plus 10–12 weeks after are covered by the maternity allowance (“zwangerschapsuitkering”).

In addition, partners of mothers who have just given birth are entitled to 1 week of paid leave (“partnerverlof” or “geboorteverlof”). For example, if the partner works 5 days a week, 5 hours a day, they will get 25 hours of “geboorteverlof”. They can also get an extra 5 weeks of unpaid parental leave.

Parents of children up to the age of 8 are also entitled to parental leave (“ouderschapsverlof”) to spend more time with their children. Each parent may take off 26 times their weekly working hours. This kind of parental leave is generally unpaid or partially paid depending on the employer.

Ending employment

It’s hard to fire an employee in the Netherlands. To dismiss a worker, the employer must have a valid reason, such as refusal to perform work, culpable conduct, excessive sickness absence, reorganization, or company closure. A notice period is usually at least 1 month.

If you’ve been employed for 2 years or more, if your employment terminates at the initiative of the employer, or if the termination is not for a serious cause, your employer must pay you a transition compensation — up to €75,000 gross, or one annual salary if this is higher.

Dutch workplace culture may be different from that of the other countries. But you can be sure to find many upsides and growth opportunities there.

Read also:

→ Relocation process in the Netherlands